It is difficult to predict trends when it comes to pre and post-payment audits in home health care – or specifically for those in the durable medical equipment, prosthetics, orthotics, and supply (DMEPOS) world as the public health emergency (PHE) is still on. With the absence of a “crystal ball,” it is necessary to look at the past and present in order to best predict the future.

The regional DME Medicare Administrative Contractors (MACs) in Regions A, B, C, and D pay Medicare claims. Except for various mobility equipment, which requires pre-authorization of the item, Medicare operates in a “pay and chase” model. In other words, they pay, then may attempt to retrieve the money they paid. An audit from Medicare may occur either before or after they pay you (called a pre-payment audit or a post-payment audit). To become a Medicare-approved supplier for DMEPOS items, you must satisfy all requirements. By doing so, payment will likely occur once you respond to an audit with a “complaint claim.”

Preparing for TPE Audits in Home Health Care

Unfortunately, that does not guarantee a smooth payment. Auditors utilize data analytics and artificial intelligence (AI) for audits. They use data to delineate the following:

- An increase in the volume of claims being billed by the supplier

- A trend of aberrant claims, outliers, or unusual billing patterns is discovered

- The supplier is in a “heat zone” identified by Medicare where other fraudulent providers have been discovered

- An increased number of claims submitted for certain products with high reimbursement rates

- An increased number of claims being submitted per beneficiary

Outside of data analytics and analysis, auditors may rely on other information they receive from outside sources, including the following:

- A complaint to Medicare by a patient or family member

- A report from a whistleblower against the supplier

- A complaint from a competitor that the supplier is engaging in unfair or illegal business practices

- Possibly during the testimony or evidence that was obtained during the investigation of another supplier

While not a complete list, the aforementioned are the most reported reasons for the audits. The reason for the audits is simple. Medicare prioritizes getting you paid and assumes that most claims are correct in its payment policy. It would be impractical for them to review every submission (there are millions). Therefore, the audits serve as a means to quickly secure payment while clarifying any over or improper payments.

The Impact of Telehealth on TPE Audits

During the pandemic, telehealth became necessary and, therefore, quite popular. It became a very convenient method for patients to get care without the risk of infection, etc. The rules for telehealth were not (and still are not) very clear. As such, telehealth has become a big “audit point.” As life returns to normal, we have been starting to see an uptick in the Targeted Probe and Educate (TPE) audits that Medicare performs.

TPEs are pre-payment audits that require explanations for you to get payment.

A TPE audit begins with an initial review of 10 claims. Regional DME Medicare Administrative Contractors (MACs) in Regions A, B, C, and D determine the supplier to have successfully completed the audit if they determine all 10 claims to be correct and complete, and they will not audit the product or HCPCS code again for a period of 12 months.

MACs in Regions A, B, C, and D pay Medicare claims. If the initial audit identifies one or more non-passing claims, the DME MAC places the supplier into Round 1 of a TPE, where it reviews 20 to 40 claims. Once the supplier passes Round 1, the DME MAC determines the audit successfully and starts the 12-month hiatus for the audited product.

The DME MAC will place them in Round 2 if they fail Round 1. The DMEMACs have not provided a specific percentage of bad claims that lead to failure, but our experience has shown it is around 20% or higher.

If still unsuccessful, the DME MAC will schedule Round 3. Hopefully, a supplier does not fail a Round 3 TPE. If they fail to comply, they risk referral to other entities where consequences can worsen beyond just an audit.

Adhering to all required documentation and rules is paramount to success in maintaining a “tight ship.” Once audited (which happens to everyone) that documentation and strict adherence to rules are necessary.

The Importance of Efficiency for TPE Audits

Having all required documentation and adhering to rules is key to passing TPE audits. With the right home health care software, you can store all necessary information in one place and easily respond to TPE audits, avoiding costly mistakes. This is especially crucial during the pandemic with the increasing use of telehealth and unclear rules.

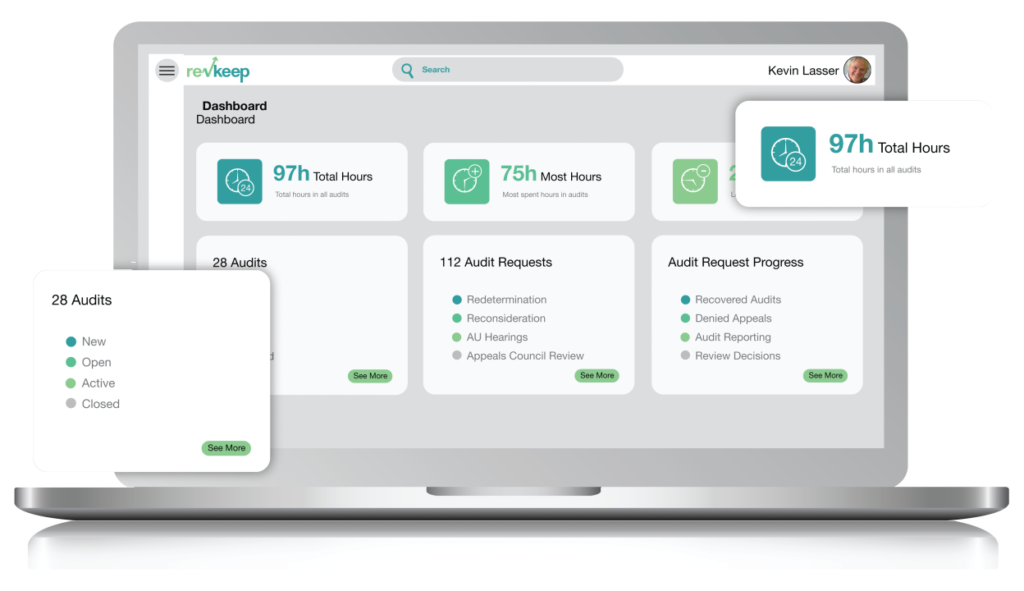

Invest in Home Health Care and Revenue Management Software

In order to succeed in the home health care industry and pass TPE audits, it is important to invest in the right software and tools. Home health care software like RevKeep can help streamline your processes and keep track of important information, while health care revenue management software can help you better manage your finances and stay compliant with regulations.